Cox Automotive is warning that Government targets for zero emission vehicle (ZEV) sales may result in manufacturers reducing volumes for the UK market.

There has been a relatively healthy start to the year for new car registrations, which were up 10.4% year-on-year in Q1, according to its Insight Quarterly (IQ) report.

However, Cox Automotive says that questions remain about the ZEV mandate's effect on the sector, what will happen after the next general election, and when the market will finally return to its pre-pandemic normality.

Philip Nothard, insight director at Cox Automotive, thinks the 10.4% statistic is good news but is still 17.9% behind the pre-pandemic average for registrations recorded between 2000 and 2019.

“Double-digit growth in the first three months is no mean feat and cannot be easily dismissed,” he said. “But it trails far behind figures before the pandemic and is, indeed, 22.2% behind the figure for 2019 alone.

“So, the numbers are charged with positivity, but the market is a long way off what could reasonably be characterised as normal.”

The first-quarter growth numbers are compounded by the market share figures of private registrations. Standing at 40.4%, they are 8% lower than the figure year-on-year.

“On top of that, consumer doubts about the transition to electric, perhaps fuelled by EV affordability and infrastructure fears, persist,” said Nothard.

“Steadfast support from fleet operators has played a crucial role in driving the transition to an electrified market and the recovery of sales volumes. These advancements would undoubtedly be less substantial without their continued backing.”

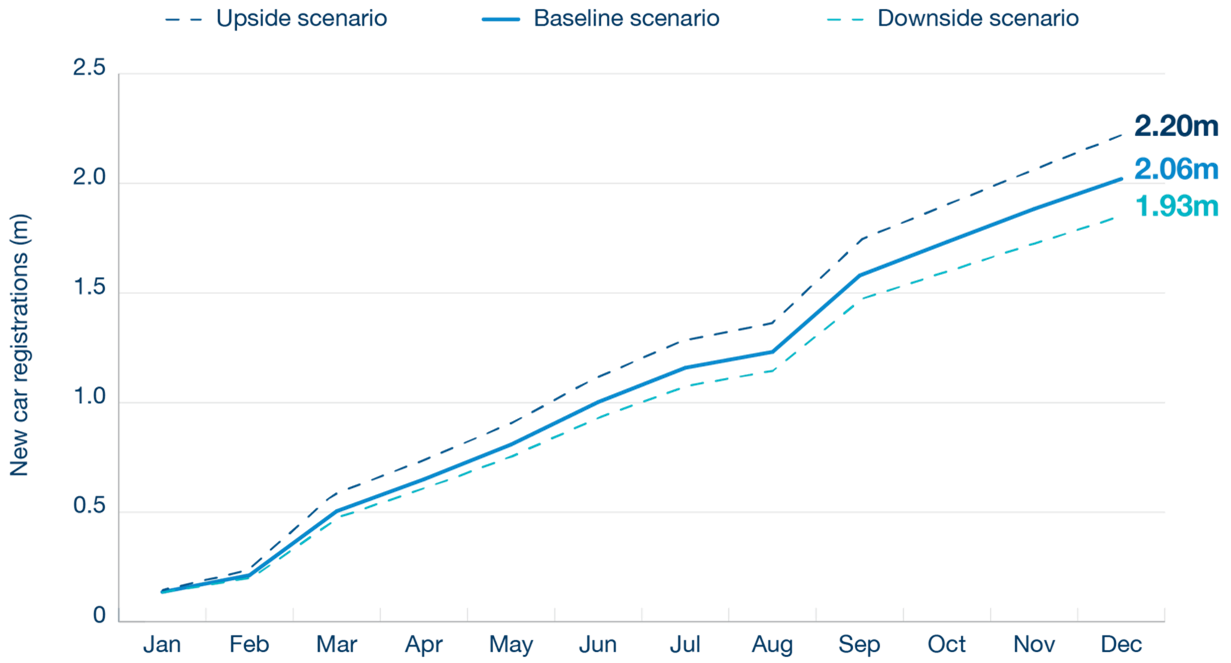

Cox Automotive has adjusted its baseline forecast for 2024 upwards and now projects registrations will surpass two million cars, with a potential upside scenario seeing it stretch beyond 2.2 million.

However, that is contingent upon a more robust performance in the second half of the year buoyed by signs of economic stabilisation alongside the imperative for manufacturers to gain market share while meeting ZEV mandate obligations.

Manufacturers can avoid the hefty per-car fines enforced by the mandate in a few ways, including borrowing a limited number of ZEV ‘allowances’ until 2026. This gives OEMs some breathing room if they struggle to meet the target in a particular year. However, the borrowing is capped and comes with a considerable 3.5% annual interest fee to motivate compliance.

However, Cox Automotive is warning that one way to achieve the 22% figure is to simply reduce volume in the UK market.

In Q1, electric vehicle (EV) registrations had a 15.5% market share, a year-on-year increase of 0.1%.

“With the UK’s ICE ban deadline U-turn, a palpable lack of help for the sector in the most recent budget, such as the Government addressing the VAT discrepancy between domestic and public charging, it may well be that an unintended consequence of the ZEV mandate could be a drop in the supply of new vehicles,” said Nothard.

“Manufacturers looking at the UK market may change tack and opt to put their cars into less stringent markets in other parts of the world.

“It’s still early days, but clarity on how the sector will react in the inaugural year of the mandate has yet to materialise.”

He concluded: “With an election looming, we will have to wait and see whether any new administration delivers the help needed to accelerate our sector’s overdue recovery.”

Login to comment

Comments

No comments have been made yet.